ALERT: California Solar Vote Upcoming

The much-anticipated vote on SB-1, the Million Solar Roofs Initiative, will likely take place in the California Assembly by Sept. 9.

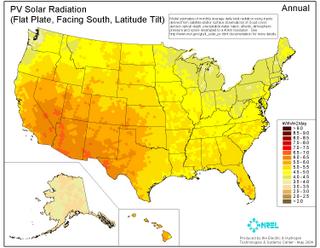

The much-anticipated vote on SB-1, the Million Solar Roofs Initiative, will likely take place in the California Assembly by Sept. 9.Supported by Gov. Arnold Schwarzenegger, the initiative is an ambitious plan to install 3,000 Megawatts of solar electric power on roofs throughout California by 2016. This writer believes all solar power is good and that the opinions of others in the industry are valuable, even if it's a competitor...

"The primary benefit of the Million Solar Roofs Initiative is that it reduces California's power needs during hot summer weekday afternoons," said Barry Cinnamon, President of Akeena Solar. "Without this 3,000 Megawatts of solar capacity, utilities must construct this generation, distribution and transmission infrastructure -- as well as operate and fuel these plants. Ratepayers will ultimately pay for these costs. Solar power is a far better way to generate this capacity since the state also benefits with cleaner air and a better economy," said Cinnamon.

It seems the key to SB-1's future is in the hands of Fabian Nunez (D-Los Angeles), the Speaker of the Assembly. However, at this stage in the game the Speaker is focused on macro issues, and SB-1 is at risk of becoming a casualty in the battle with the Governor and unions.

Challenges to SB-1

There are currently two major challenges facing the adoption of SB-1. The first challenge is that certain unions want all of the solar work in the state to be done using "prevailing wages" - essentially union wages. "When we ran our model using these prevailing wage rates the costs to the state for the Million Solar Roofs Initiative were increased by $750 million," said Cinnamon. (SD Dave: I have nothing against unions, in fact I grew up in a union family. Ideally, union-trained electricians are quite able and they take pride in the quality of their workmanship. However, my experience with union installers is no better or worse than with non-union contractors.)

The second challenge is simply that SB-1 replaces conventionally utility power generation and distribution. It is understandable that utilities would like to continue generating and delivering this incremental power to customers. However, it is only by installing these systems on business and residential rooftops that costs for additional transmission and distribution systems can be avoided.

Assuming you're a California resident and pro-solar, take a stand for SB-1 and contact Assemblyman Fabian Nunez at Assemblymember.nunez@assembly.ca.gov.

While you're at it, express your support to your assembly member at:

http://www.assembly.ca.gov/acs/acsframeset7text.htm

Don't know your assemblyman? Go to: http://www.assembly.ca.gov/defaulttext.asp

Then click on "Find My District."

(Read Akeena Solar's White Paper "California To Save Over $6 Billion From Million Solar Roofs Initiative" in the Renewable Energy Updates link at right.)